Starting October 1: Some business services are now subject to retail sales tax, as required by state law, ESSB 5814. When you buy these services, vendors should add sales tax to your bill. If you sell these services, you should begin collecting retail sales tax. Learn more about Services newly subject to retail sales tax.

Property tax

The Department of Revenue oversee the administration of property taxes at state and local levels. We do not collect property tax.

Your county assessor and treasurer administer property tax

- County assessors value (assess) your property

- County treasurers collect property tax

Contact your local county officials.

Understanding property tax (video 3:30)

Property tax is the oldest tax levied in the state of Washington, and it’s also one of the more difficult to understand. Property taxes are essential for funding local services such as fire protection, libraries, parks and recreation, and public schools. Watch our Understanding Property Tax video and learn the basics of property tax.

Homeowner’s exemptions, deferrals and assistance

If you live in Washington and meet certain criteria such as age and income, you may be eligible for either an exemption or deferral.

Exemption

Deferrals

Assistance

Nonprofit organization exemption

- Nonprofit property tax

- How to renew your property tax exemption

- Locate the status of an exempt nonprofit property by county

Frequently asked questions

-

What is property tax?

-

In Washington State, all real and personal property is subject to tax unless specifically exempted by law. Property tax was the first tax levied in the state of Washington. Today, property tax accounts for about 30% of total state and local taxes. It continues to be the most important revenue source for public schools, fire protection, libraries, and parks and recreation.

Revenue at a Glance provides more detail on property taxes and how they help fund these services.

- Who administers property tax?

-

Property taxes are administered at the local level by county officials. Your county assessor determines the value of your property, and the county treasurer collects your property taxes and distributes them to local governments.

The Department of Revenue does not collect property tax. We oversee the administration of property taxes at the state and local levels.

- How is my property valued?

-

State law requires that county assessors appraise all property at 100% of its true and fair market value in money, according to the highest and best use of the property. Fair market value or true value is the amount that a willing and unobligated buyer is willing to pay a willing and unobligated seller. The county assessor values real property using one or more of three professional appraisal methods.

For more information on how your residential property is assessed and valued see A Homeowner's Guide to Property Taxes (pdf).

- What is the difference between real property and personal property?

-

Real property includes land, improvements to land, structures, and certain equipment affixed to structures. Personal property includes furnishings, machinery and equipment, fixtures, supplies, and tools. The primary characteristic of personal property is its mobility. Personal property tax applies to personal property used when conducting business or to other personal property not exempted by law. Most personal property owned by individuals is specifically exempt. However, if these items are used in a business, personal property tax applies.

Understand your tax obligations. Watch our Personal property tax video.

- Where to pay my property tax?

-

You should pay your property taxes directly to the county treasurer's office where your property is located. We've provided contact information for Washington's 39 counties to assist you.

Learn more about paying or appealing your property tax.

- Can I appeal my property valuation?

-

You may appeal your property’s assessment to the county board of equalization in the county where your property is located.

- Where does my property tax go?

-

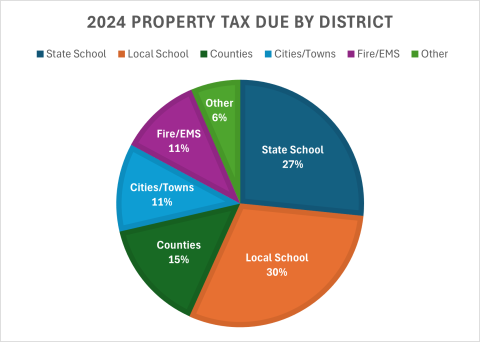

Property tax is the primary funding source for essential local services, including public schools, fire protection, libraries, and parks. The chart below shows the average property tax distribution statewide. To view more information, visit our interactive map with county values, levy rates, and levy amounts.

- What if I can't pay my property tax?

-

After April 30th, property taxes are considered delinquent and subject to 1% interest per month. If your taxes are still delinquent on June 1st, you are subject to a 3% penalty. Interest continues to accrue until the taxes are paid in full. If you pay the first half of your taxes by April 30th, but fail to pay the second half by October 31st, the unpaid portion is subject to 1% interest per month. Any taxes still owing on December 1st are subject to an additional 8% penalty.

For example, if you pay your 2023 property taxes on December 31, 2023, the amount due includes 8% interest (May through December) and an 11% penalty.

Skip to main content

Skip to main content